Observe, Orientate, Decide and then Act

If one is to know truly one must see truly. The power and importance of observation cannot be overstated. The stock market is not an environment that allows the application of the scientific method. We cannot subject a control group to a certain stimuli and draw conclusions from the findings. It is more analogous to astronomy where orbitals and complex vector space is quantified by understanding position and momentum and attributing values to each.

An inherent problem with observation is that we tend to perceive what we expect to perceive and our perceptions resist change even in the face of new and better data. In addition, conclusions drawn from a small body of consistent data engenders more confidence than those drawn from a larger body of less consistent data. It is a critical junction where judgment becomes more important than knowledge. Once you evaluate your observations you must orientate your exposure to the long and/or short side of the market and then decisively act.

Based on the foregoing, these are my views and observations:

The Trade - I suspect that (LLY) is a short at $41.50. I would only establish ¼ of the position at $41.50 and the remaining ¾ at $44.00 with a stop out at $46.25. I would never post my stop loss. It is too easy for the Designated Market Maker to cash investors out by raising the price above the stop out and move the price right back down again. Remember the "Flash Crash"? This is a short-term trade and nothing more. I would be looking to cover at $38.00. This is based on the facts that we know at the present time.

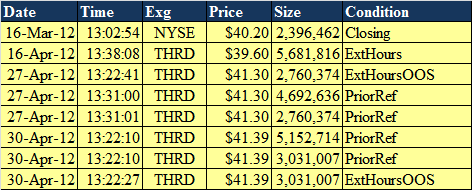

I believe Insiders have been distributing and selling short. It is in the process of forming a double top. In addition, it is currently at the higher levels of a trading range and this is occurring to the accompaniment of an increase in big block activity and heavy aggregate volume (300% greater than the 3-month average). When you witness this type of activity you can be fairly certain (but not positive) that insiders are liquidating positions and selling short.

I believe that the Designated Market Maker in this issue has depleted his inventory and will drop the price in order to cover his short positions, replenish his inventory and accumulate from the selling which ensues.

(click to enlarge)

Although the blocks below are controlling the pattern they are not large enough to expect a long-term trend reversal. They are more indicative of a reversal in a trading range. In this case a sideways channel pattern. They also have occurred at clearly obvious support/resistance levels, which make them all the more significant.

Blocks, which evidence themselves at the reversal of a long-term trend in this issue, should be about 20,000,000 shares or greater or a series of blocks aggregating a position of that magnitude. A pullback to $38.00 to $39.00 is most likely. I might just split the difference for the cover.

That's it for now ...have a nice day.

No comments:

Post a Comment